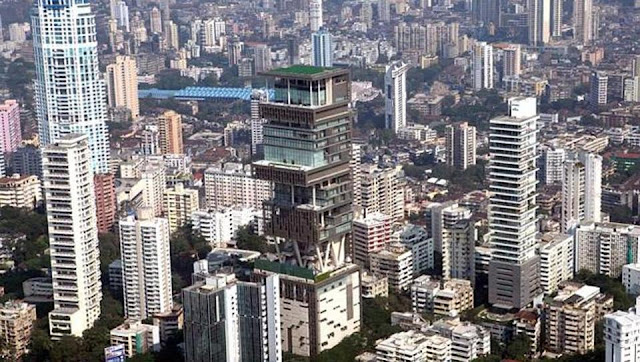

5 Steps To Buy A House, For First Time House Buyers In Mumbai

Planning to buy your dream house in 2019? We look at some of the

Finance is one of the most important determinants, when it comes to buying a house Property in Mumbai of the other considerations revolve around this. As a property purchase is often a once-in-a-lifetime decision, it is essential to evaluate your funds accordingly. To buy a home, one nowadays has to

Track your spending:

Real estate is an expensive investment. However, with modern buyers being exposed to global standards, they refuse to settle for anything but the best. In such a scenario, every penny counts. Experts suggest that an individual’s monthly budget should be based on the 50/30/20 thumb rule, where one spends 50 per cent on basic necessities, including groceries, utilities, medical expenses, etc., 30

Pay off all your existing debts:

You can never assess your net worth, if you are debt-laden. Any partial payment towards this debt, will show up poorly in your credit ratings and this may affect the house loan process. Paying off your debts completely, will help you move ahead in the direction of house buying. Besides relieving one’s tension, it can help you to properly allocate money for your basic requirement and for your big real estate purchase.

Invest in multiple assets:

One should learn about the different financial instruments available in the market. This can help you to invest your money wisely and use the returns, to fund the purchase of your house. Financial experts always stress on having a mix of different asset classes in one’s portfolio, as this will help you during big-ticket purchases, like

Standing instructions for automatic transfer of money:

Initiate standing instructions at your bank, for transferring money from your salary account to your savings account, every month. This will keep you in check and you will only spend what is left

Maintaining a balance between rent and EMIs:

Proper planning is especially important, when one plans to buy a home while also living in a rented accommodation. This will entail an

Comments

Post a Comment